long term care insurance washington state tax opt out

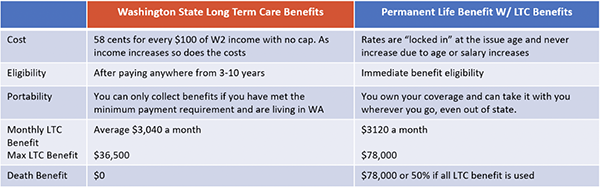

Often long-term care insurance will only begin to cover care once the beneficiary needs assistance with at least two ADLs. Monthly benefits are often much higher than SSDI.

Washington Long Term Care Tax How To Opt Out To Avoid Taxes

A more detailed discussion of long term care insurance is available.

. The payroll tax funds the Washington Cares Fund which is intended to provide financial assistance for long-term care. KOA offers level clean sites for long-term RV parking. A small number of families are fortunate enough to have long term care insurance perhaps 5 of American seniors.

Note that purchasing long-term care insurance once you already need care is typically not an option and if it is. Regional ombudsmen and volunteers work to enhance the quality of life and services for people receiving long-term care services. So those only in need of companion care may not be covered even if they do have long-term care insurance.

You might get a variable annuity for long-term growth that is tax-deferred. By estimating the overall risk of health risk and health system expenses over the risk pool an insurer can develop a. The Office of Ombudsman for Long-Term Care is a program of the Minnesota Board on Aging.

Planning for long term care under age 40. Long-term care LTC insurance according to Washington state law legwagov is an insurance policy contract or rider that provides coverage for at least 12 consecutive months to an insured person if they experience a debilitating prolonged illness or disabilityLTC insurance typically covers the following types of services if theyre provided in a setting other than a hospitals. Each site comes with both 30-amp and 50-amp service.

Insurance in the United States refers to the market for risk in the United States the worlds largest insurance market by premium volume. You can buy annuities for reasons that include safety long-term growth or income. What financing options might be best for me.

Insurance generally is a contract in which the insurer agrees to compensate or. Washington registration and tax info Before you can pay employees make sure youve registered for payroll in their applicable work state. This can sometimes take several weeksthe sooner you start the process the sooner youll have the tax account info required to pay them.

10 In this scenario selling may be their only viable option. Public option and standardized plans became available as of 2021 and premium-free Silver plans are available for 2022 for child. Planning for long term care between ages 40 and 60.

Treasury Approves Four Additional State Plans to Support Underserved Entrepreneurs and Small Business Growth Through the State Small Business Credit Initiative. Pick one of our locations in the South where you can. Workers who wish to apply for an exemption because they hold a long-term care insurance plan purchased by Nov.

Claim payments can last to age 65 or longer. Kab Nras Lee 651-230-9999 Metro number. By camping long-term youll get out of that rut no matter what time of year it is.

Learn more about Washington State long-term care trust act tax exemptions and coverage. For instance a fixed annuity might be a good low-risk option instead of a CD that offers low interest rates. For tax resources and information on how to request a duplicate tax statement review the Tax Statement web page.

The ObamaCare Employer Mandate Employer Penalty originally set to begin in 2014 was delayed until 2015 2016ObamaCares employer mandate is a requirement that all businesses with 50 or more full-time equivalent employees FTE provide health insurance to at least 95 of their full-time employees and. The Washington State Legislature established a long-term care insurance benefit for all eligible workers to address the future long-term care crisis. State tax refund offset.

However once the home is. Purchasing a private policy to qualify for a WA Cares exemption was a voluntary decision by. Individuals who purchased a long-term disability fare best after they suffer a loss that keeps them out of work for an extended period.

The state of Washington operates its own health insurance exchange Washington Healthplanfinder. Medicaid provides health and long-term care for millions of Americas poorest and most vulnerable people acting as a high risk pool for the. According to Swiss Re of the 6287 trillion of global direct premiums written worldwide in 2020 2530 trillion 403 were written in the United States.

1 2021 must still apply by Dec. Planning for long term care needs if you are over age 70. Daily Treasury Long-Term Rates.

These are workers who live out of state military spouses workers on non-immigrant visas and veterans with a service connected disability rating of 70 or more. However for those who do not have long term care insurance and have a need for care it is no longer possible to purchase these policies. You can opt for a Pull-Thru RV Site or a Back-In RV Site whichever you prefer.

Long Term Care Insurance. The University deducts the required federal and state taxes from an employees earnings. First they address off-the.

The Employer Mandate Employer Penalty. View All Press. Private long-term disability policies bridge the two gaps in public plans.

Health insurance or medical insurance also known as medical aid in South Africa is a type of insurance that covers the whole or a part of the risk of a person incurring medical expensesAs with other types of insurance risk is shared among many individuals. Planning for long term care if you are between 60 and 70 years of age. Long-term disability insurance premiums Unpaid Leave only Paying for benefits.

You may opt for an annuity that will bring you income in the future. Care coordination for all Washington State foster care and adoption support enrollees is provided. Adoption support and alumni have the ability to opt out of managed care for their physical health coverage with a phone call to the Foster Care and.

All employees must complete a W-4 tax withholding election. Sooner or later recipients may not have sufficient funds to pay property taxes insurance or other expenses necessary to maintain their homes after spending most of their income to meet Medicaid s monthly share-of-cost payments for long-term term care. What programs do not pay for long-term care.

Treasury Releases Initial Information on Electric Vehicle Tax Credit Under Newly Enacted Inflation Reduction Act.

What You Need To Know About The New Washington State Long Term Care Act Coldstream Wealth Management

How Do You Opt Out Of Washington State S Long Term Care Tax Youtube

Washington S Long Term Care Payroll Tax And How To Opt Out Alterra Advisors

Washington State Trust Act Should You Opt Out Buddyins

What You Need To Know About The New Washington State Long Term Care Act Coldstream Wealth Management

Washington State S New Payroll Tax Ignore At Your Own Peril Joslin Capital Advisors

Long Term Care Enrollment Deadline Extended To Oct 14 Afscme Council 28 Wfse

Washington State Long Term Care Tax Here S How To Opt Out

Ltca Long Term Care Trust Act Worth The Cost

Time Expiring For Washington Residents In 30s And 40s To Avoid New Tax American Association For Long Term Care Insurance

Washington State Long Term Care Tax Avier Wealth Advisors

Answers To Your Questions On The New Washington Cares Fund And The Long Term Care Payroll Tax The Seattle Times

Updated Get Ready For Washington State S New Long Term Care Program Sequoia

What To Know Washington State S Long Term Care Insurance

The Washington State Long Term Care Trust Act Opt Out Is Now Available Online Parker Smith Feek Business Insurance Employee Benefits Surety

Analyst S Advice For Washingtonians Who Got Private Long Term Care Insurance Mynorthwest Com

Making Sense Of Washington S New Long Term Care Law Parker Smith Feek Business Insurance Employee Benefits Surety

-1.jpg?width=565&name=WA%20Trust%20Act%20Tax%20(based%20on%20salary)-1.jpg)

Washington State Is Creating The First Public Ltc Plan Who S Next